|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

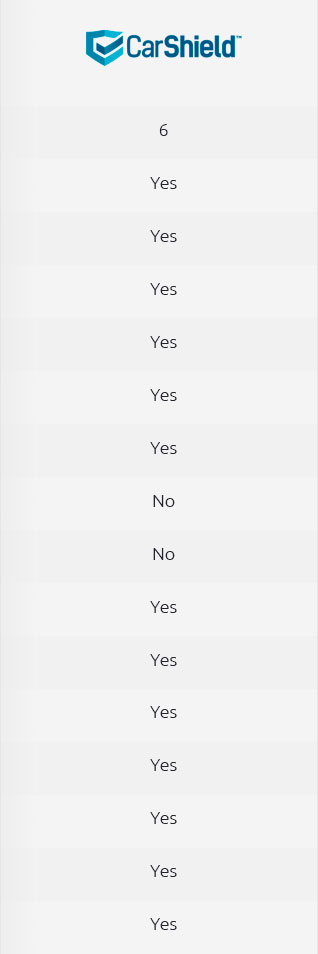

Gap Insurance Providers: Comprehensive Coverage Guide for U.S. ConsumersWhen it comes to protecting your vehicle, understanding gap insurance providers can be crucial for U.S. consumers. This type of insurance offers peace of mind by covering the 'gap' between what your vehicle is worth and what you owe on it. It's especially beneficial if your car is totaled or stolen, ensuring you don't end up paying out of pocket for a car you no longer have. Understanding Gap InsuranceGap insurance is a smart choice for many, especially for those with auto loans or leases. Let's delve into what it covers and why it's an essential part of auto warranty protection services. Benefits of Gap Insurance

Exploring Vehicle Protection OptionsIn the U.S., there are various options when it comes to vehicle protection. Choosing the right one depends on your specific needs and financial situation. Consider nissan xterra extended warranty options for additional coverage and protection. Factors to Consider

In cities like New York and Los Angeles, where vehicle costs and risks can be higher, gap insurance provides an extra layer of financial security. Whether you're cruising down Broadway or navigating the freeways of Los Angeles, knowing you have this coverage can make all the difference. FAQsWhat is gap insurance?Gap insurance covers the difference between your car's actual cash value and the amount you still owe on your loan or lease in the event of a total loss. Do I need gap insurance if I have a good auto insurance policy?While a comprehensive auto insurance policy covers damage to your car, it may not cover the total amount you owe on your loan or lease, making gap insurance a wise choice for added protection. How much does gap insurance typically cost?Gap insurance usually costs about 5% to 6% of your comprehensive and collision coverage premium, making it an affordable option for many drivers. In conclusion, whether you're in bustling New York or sunny Los Angeles, choosing the right gap insurance provider can help ensure you're covered against unexpected costs. With options like extended warranties and vehicle protection plans, you're in a better position to protect your investment and enjoy the road ahead. https://www.reddit.com/r/personalfinance/comments/146xabj/where_to_buy_gap_insurance_on_a_new_car_from/

... insurance", but are really referring to policies that also require you to have auto insurance with the provider that's offering the gap coverage ... https://easycare.com/other-vehicle-coverage/guaranteed-asset-protection/

Our Guaranteed Asset Protection (GAP) coverage protects you from paying large out-of-pocket expenses for the gap between your insurance settlement and the ... https://wallethub.com/edu/ci/best-gap-insurance/94139

Best Gap Insurance Companies. Travelers; The Hartford; Liberty Mutual; Nationwide; Kemper; Progressive; Esurance. Gap insurance is a type of car insurance that ...

|